reverse sales tax calculator ontario

This marginal tax rate means that your immediate additional income will be taxed at this rate. Ontario Sales Tax HST Calculator 2022.

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com

Age Amount Tax Credit 65 years of age 789800.

. Instead of using the reverse sales tax calculator you can compute this manually. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Amount without sales tax QST rate QST amount.

Ensure that the Find Subtotal before tax tab is selected. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Federal Basic Personal Amount.

Company XYZ sells goods cost of 100000 to the customer. Following is the reverse sales tax formula on how to calculate reverse tax. The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax.

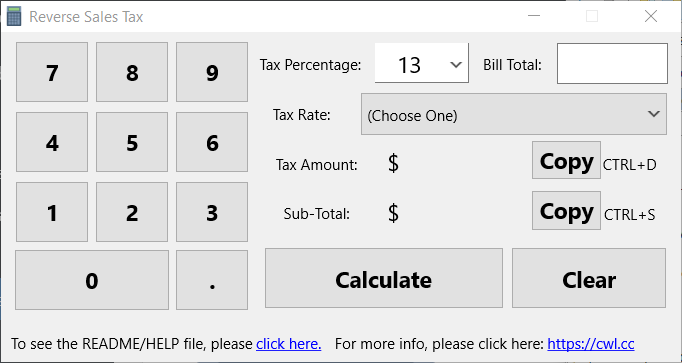

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. Any input field can be used.

Amount without sales tax GST rate GST amount. Enter the sales tax percentage. Amount without sales tax x HST rate100.

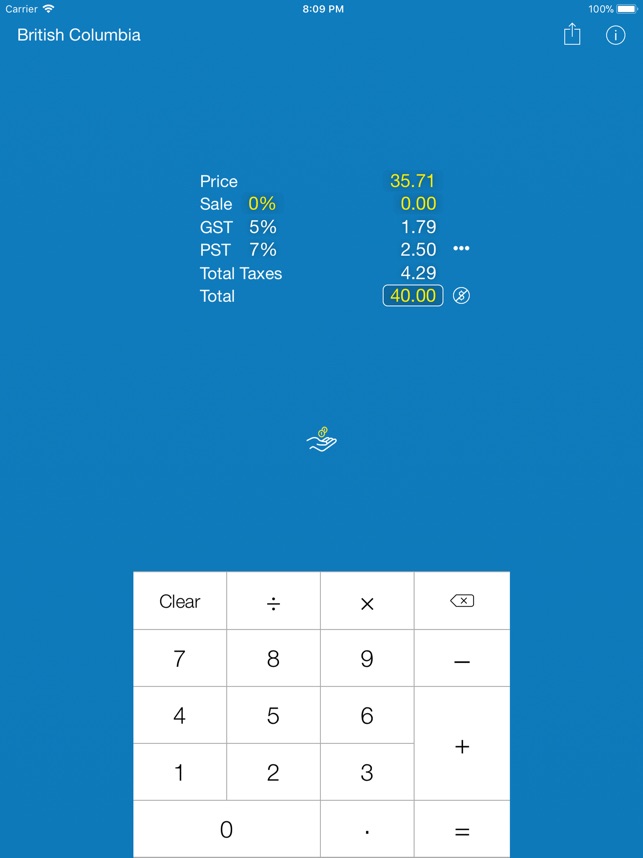

This calculator can be used as well as reverse HST calculator. GSTHST provincial rates table. Formula for calculating reverse GST and PST in BC.

Your average tax rate is 270 and your marginal tax rate is 353. How to Calculate Reverse Sales Tax. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Province of Sale Select the province where the product buyer is located. Most transactions of goods or services between businesses are not subject to sales tax. Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used.

The reverse sale tax will be calculated as. Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value. Type of supply learn about what supplies are taxable or not.

To calculate the subtotal amount and sales taxes from a total. The HST was adopted in Ontario on July 1st 2010. To find the original price of an item you need this formula.

In addition to this company needs to charge a sale tax of 5. That means that your net pay will be 37957 per year or 3163 per month. So the sale tax amount equal to 5000 100000 5.

Who the supply is made to to learn about who may not pay the GSTHST. Enter the total amount that you wish to have calculated in order to determine tax on the sale. The rate you will charge depends on different factors see.

Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is. Ontario Basic Personal Amount.

Amount with sales tax 1 HST rate100 Amount without sales tax. Sales Taxes in Ontario. Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price.

The following table provides the GST and HST provincial rates since July 1 2010. GSTHST Calculator Before Tax Amount Reverse GSTHST Calculator After Tax Amount. OP with sales tax OP tax rate in decimal form 1.

Enter price without HST HST value and price including HST will be calculated. Ontario Personal Income Tax Brackets and Tax Rates in 2022. Enter HST value and get HST inclusive and HST exclusive prices.

Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse. If you want a reverse HST calculator the above tool will do the trick. 13 for Ontario 15 for others.

Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator. Calculates the canada reverse sales taxes HST GST and PST.

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. This is very simple HST calculator for Ontario province. Current Provincial Sales Tax PST rates are.

It is very easy to use it. Here is how the total is calculated before sales tax. Where the supply is made learn about the place of supply rules.

Reverse Sales Tax Formula. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Formula for reverse calculating HST in Ontario.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. The given number will be the pre-HST number that will be calculated. Amount without sales taxes x.

HST Tax Rate. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. PST 8 400 GST 5 250 HST 13 650.

WOWA Trusted and Transparent. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. This simple PST calculator will help to calculate PST or reverse PST.

That entry would be 0775 for the percentage. Margin of error for HST sales tax. There are times when you may want to find out the original price of the items youve purchased before tax.

You have a total price with HST included and want to find out a price without Harmonized Sales Tax. Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below.

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Hst Calculator Hstcalculator Ca

Alberta Gst Calculator Gstcalculator Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

British Columbia Gst Calculator Gstcalculator Ca

Pst Calculator Calculatorscanada Ca

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com

Sales Tax Canada Calculator On The App Store

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Kiremit Kol Aksan Reverse Sales Tax Calculator Suitessansbastian Com